- The Financial Times newspaper has created a game that lets you try out being CEO of a tech startup.

- As founder and CEO, your mission is to “balance profit and purpose,” using limited resources to keep investors and stakeholders happy.

- The game draws from real life examples, like recently-ousted WeWork CEO Adam Neumann.

Have you ever looked at the decisions of CEOs like Adam Neumann or Elon Musk and thought you could do a better job? Well, here’s your chance.

FT, the publisher of the daily business newspaper, created a game that makes you CEO and founder of tech startup FlexBird. Your job is to take the company public in an IPO and to guide the business to success. Along the way, you can choose how you allocate resources to growth and social issues, but make sure you keep stakeholders and investors happy!

You’ll also have to deal with other events as they come up, like protests over government contracts and a recession. Do you have what it takes?

Here’s what happened when I played.

The game starts by giving you the basics: you're the CEO of FlexBird, and you have to make it through the next 4 years.

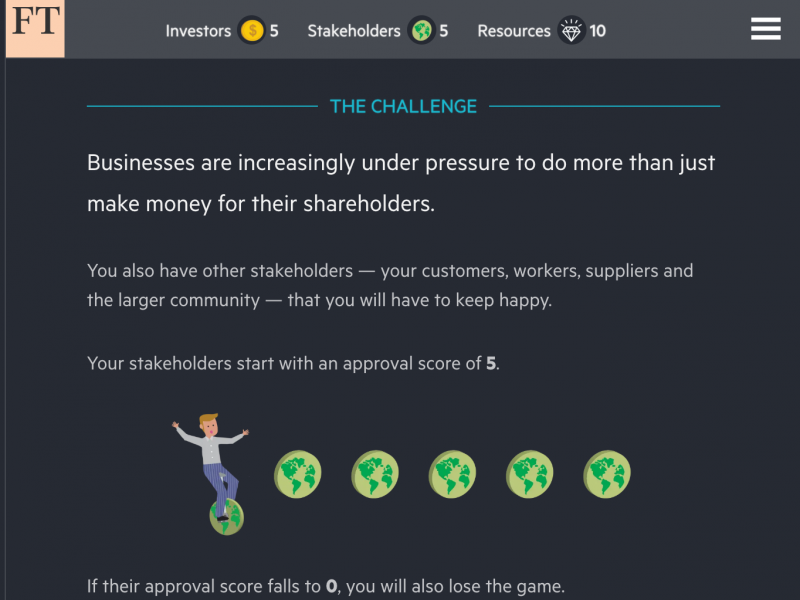

You have to keep stakeholders and investors happy.

Before the IPO, you have a chance to set up what kind of company you will run.

You have 10 resources to allocate to 4 possible areas.

I spread my resources pretty evenly. I decided to focus on meeting growth targets and social responsibility, because it seemed like it had something for both groups I was trying to win over.

Let's see how my picks played out.

Growth targets didn't do so well, even though I gave 3 resources.

Social responsibility is off to a good start.

Seems like I didn't pay enough attention to environmental sustainability.

Long term growth is decent, and we're off!

Questions about a startup with government contracts sound familiar.

This could be inspired by many real-life startups. IT automation firm Chef declined to renew its contract with ICE in September. More than 1,200 students around the country pledged not to work with data company Palantir unless it stopped working with ICE.

The majority of players made the same choice as me and dropped the contract.

A trade war is not good news for me.

This year I only have 8 resources, so I gave 2 to each sector.

Short term growth isn't going so well.

Neither is environmental responsibility.

In a very gig-economy move, I hired freelancers to avoid paying for benefits.

And now I have echoes of WeWork, renting out space to other startups.

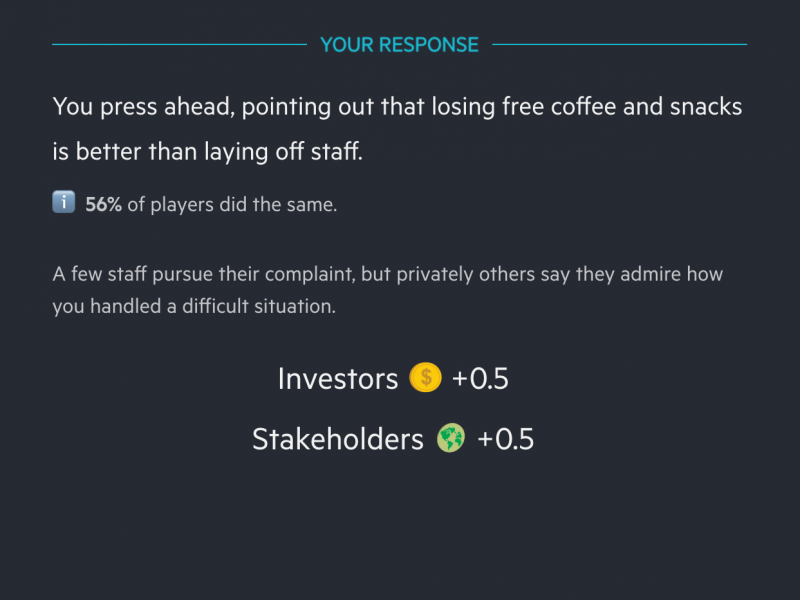

Now I have to decide whether I should fire the company barista. So many tough calls!

Most players agreed with me and fired the barista, and it worked!

FlexBird needs a little help, so we brought in investor Purposework Capital. Could this be our SoftBank?

SoftBank backed companies like WeWork and Uber, which have faced a failed IPO and a drop in valuation.

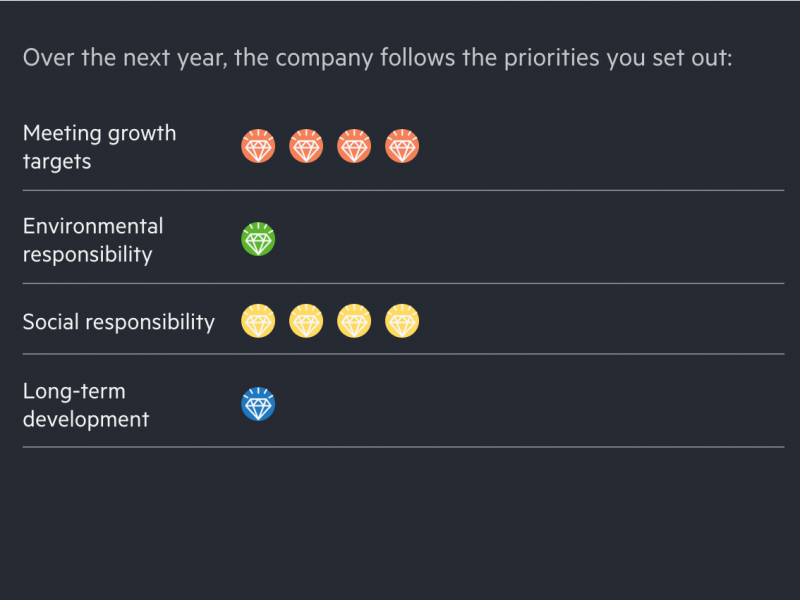

This time, I decided to focus more on growth and social responsibility.

Banning meat from company functions is definitely a Neumann reference.

The WeWork founder reportedly ate a giant lamb shank at a company dinner after banning meat.

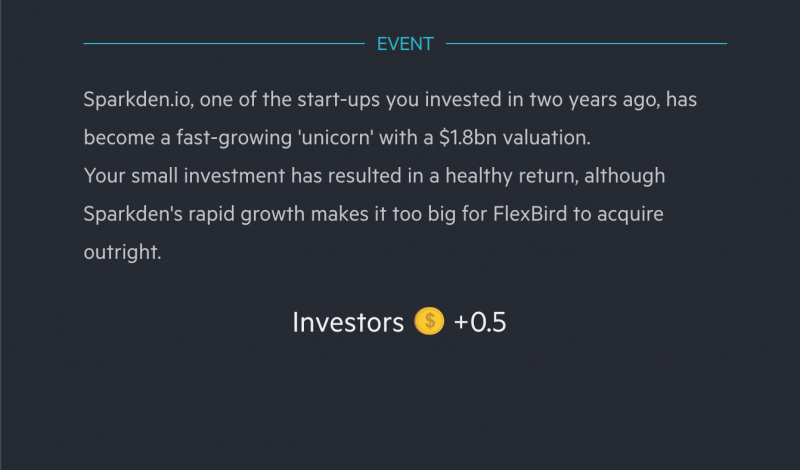

Some of my earlier investment are paying off.

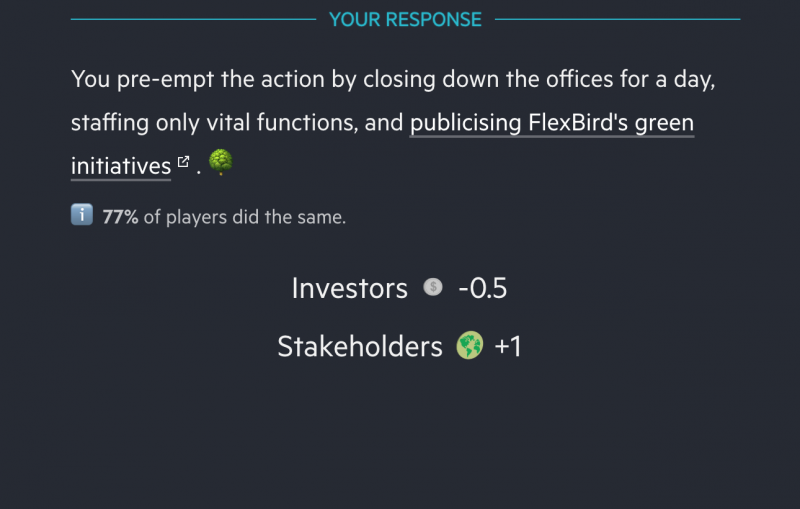

I didn't put many resources toward environmental responsibility, but I can at least let my employees join the global climate strike.

Investors didn't like it, but stakeholders did.

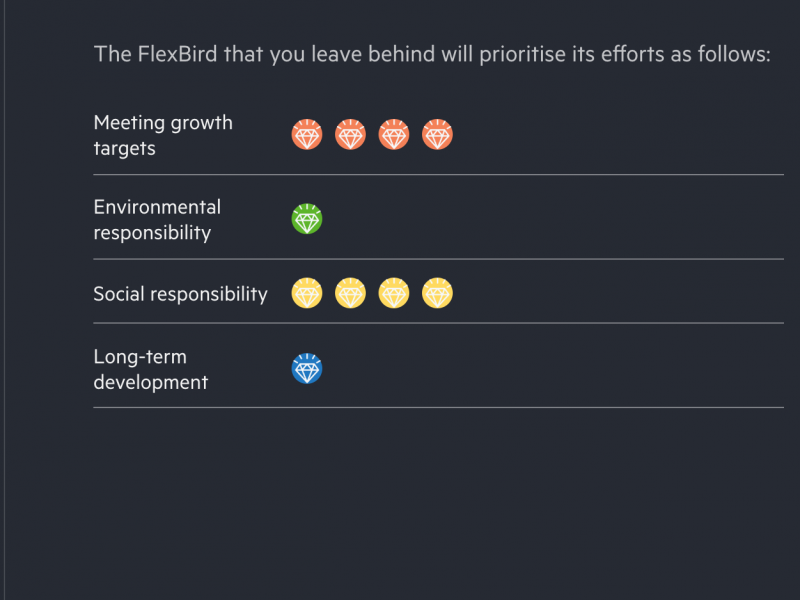

For my last year, I get to set the tone for my legacy.

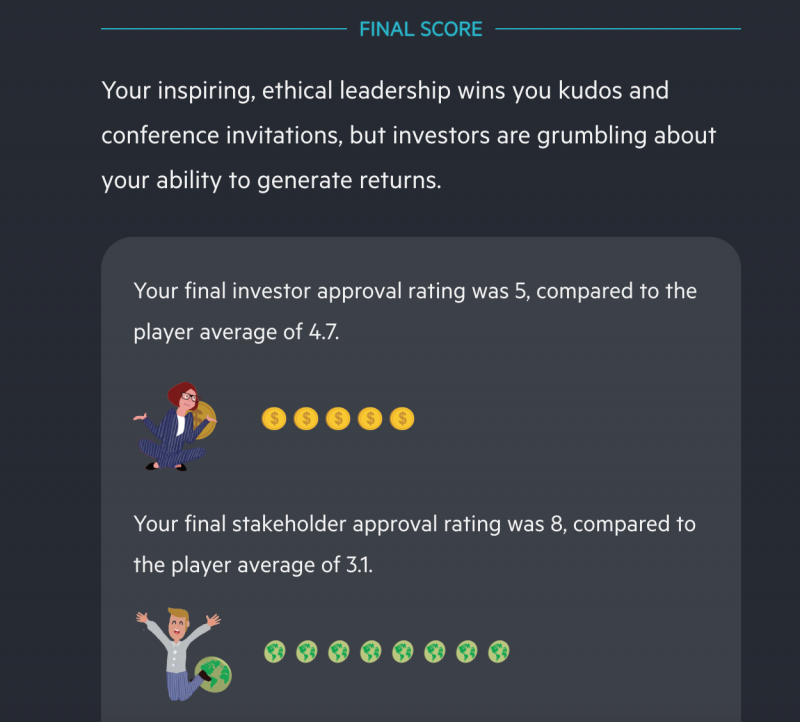

I think I won. Investors aren't thrilled with me, but I ended with slightly higher than average investor approval, and more than double average stakeholder approval.